oregon statewide transit tax exemption

Employers may be relieved of the duty to pay transit tax where it can be shown to the satisfaction of the department that subject wages paid to each individual employee will be 300 or less in a calendar year. Oregon Unemployment Tax Definition.

What Is The Oregon Transit Tax How To File More

The tax is one-tenth of one percentor 1 per 1000and your employer withholds it from your wages.

. The STI tax is calculated on wages earned by an employee who is an Oregon resident regardless of where the work is performed or. The statewide transit tax is calculated based on the employees wages as defined in ORS 316162. 1 wages paid to residents of Oregon regardless where they work.

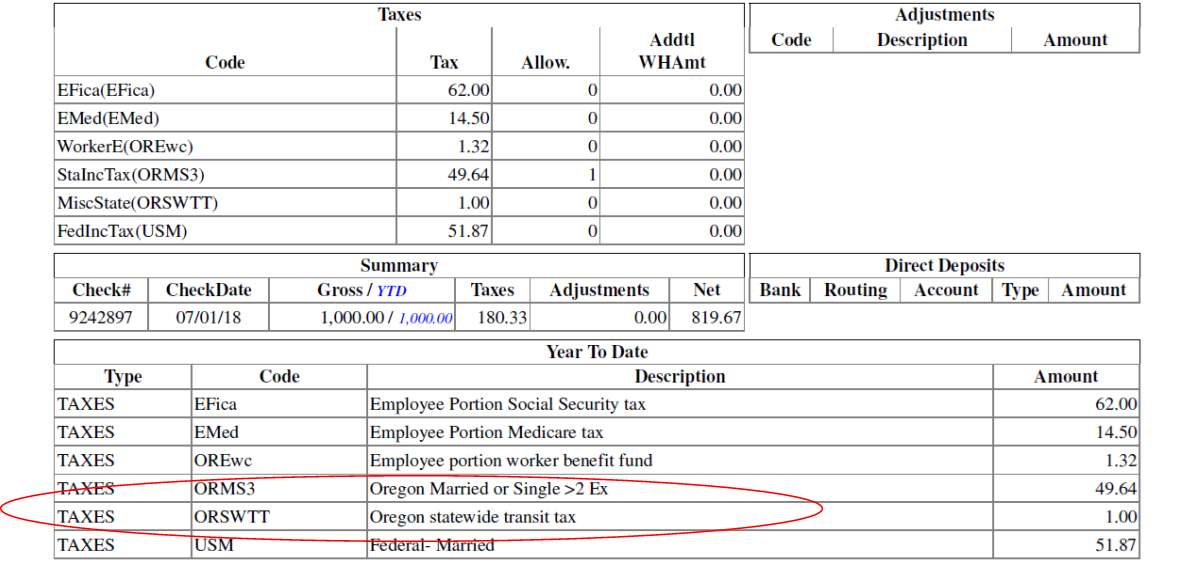

The 2017 Oregon Legislature passed House Bill HB 2017 which included the new statewide transit tax. Pay 20000 or more in cash wages in a calendar quarter or have 10 or more employees in each. Because employers will begin withholding the new transit tax on July 1 2018 they will need to file a statewide transit tax return beginning for the third quarter 2018 due by October 31 2018.

Employees who arent subject to regular income tax withholding due to high exemptions wages below the threshold for income. Oregon Statewide Transit Individual Tax Return Instructions 2021. Unless there is a regulation under Texas law if they have employees in Oregon they need to withhold Oregon tax.

Any individual or organization with employees working for pay is an employing unit. Who Must File and Pay Statewide Transit Tax. See American Indian under the subtractions section of Publication OR-17.

This includes employees with high exemptions or who have wages below the. Federal credit unions 501c3 nonprofit. The statewide transit tax requires employers to with-hold the tax one-tenth of 1 percent or 001 from.

11111 e 3121 Page 2 of 3 Fo nstruco Line 2. The tax is one-tenth of one percent 001or 1 per 1000. Income received by a nonresident who is exempt from state income tax under OAR 150-316-0173 air carrier employees and Amtrak Act or ORS 3161278 hydroelec -.

Wages of Oregon residents regardless of where the work is. If an employee is an Oregon resident but your business isnt in. This tax must be withheld on.

Withhold the state transit tax from Oregon residents and nonresidents who perform services in Oregon. Oregon Statewide Transit Individual Tax Return Instructions 2020 These instructions were updated on April 1 2021 to reflect Directors Order 2021-01. The following are exempt from transit payroll taxes.

This requirement mirrors the requirements for state income tax withholding. Because employers will begin withholding the new transit tax on July 1 2018 they will need to file a statewide transit tax return beginning for the third quarter 2018 due by October 31 2018. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

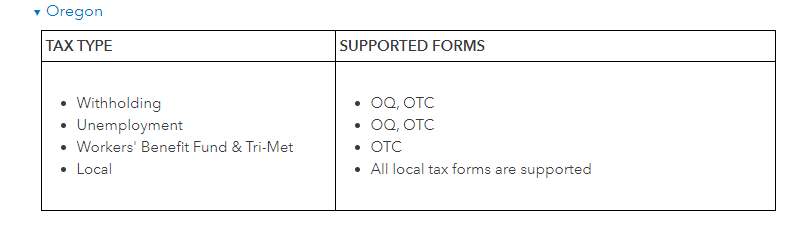

Please note those exempt from income tax withholding arent exempt from withholding for this tax. A Statewide transit tax is being implemented for the State of Oregon. A separate statewide transit tax annual reconciliation report employee detail report and payment coupon will also be used.

Lets run a Payroll Detail Review report to check your employees tax deductions. The statewide transit tax is calculated based on the employees wages as defined in ORS 316162. Employer-Employee Application 150.

The Oregon Statewide Transit Tax has the same Special Compensation and Cafeteria 125 tax liability as Oregon state income tax. Employing units which meet. Employees who arent subject to regular income tax withholding due to high exemptions wages below the threshold for income tax.

The tax rate is 010 percent. On July 1 2018 employers must start withholding the tax one-tenth of 1 percent or 001 from. Oregon Transit Payroll Taxes for Employers A guide to TriMet and Lane Transit Payroll taxes 150-211-503 Transit self.

In 2017 the Oregon Legislature passed House Bill HB 2017 which included the statewide transit tax. The transit tax will include the following. The statewide transit tax is calculated based on the employees wages as defined in ORS 316162.

There are some organizations whose payroll is exempt from transit payroll tax eg. On July 1 2018 employers must start withholding the statewide transit tax which is one-tenth of 1 percentfrom. Tax Multiply the amount on line 1.

Visit the Oregon Department of Transportations website. Oregon Statewide Transit Tax Starting July 1 2018 youll see a new item on your paystub. Even though such organizations may be exempt from paying income tax.

Wages of Oregon residents regardless of where the work is performed. Oregon Statewide Transit Tax Exemption. Annual reconciliation Form OR-STT-A Oregon Annual Statewide Transit Tax Withholding Return must be filed January 31 each year.

July 1 2018. The transit tax is imposed directly on the employer. Employees who arent subject to regular income tax withholding due to high exemptions wages below the threshold for income tax withholding.

Transit payroll taxes are a tax on the employer that is paid by the employer based on the amount of payroll earned within a transit district. Under Oregons new Statewide Transit Tax employers must start withholding the tax one-tenth of 1 percent or 01 from wages of Oregon residents regardless of where the work is performed as well as wages of nonresidents who perform services in Oregon. Wages of nonresidents who perform services in Oregon.

The statewide transit tax. The state - wide transit tax STT is calculated based on the employ - ees wages as defined in ORS 316162. The Statewide Transit Individual STI tax helps fund public transportation services within Oregon.

Choose Payroll Detail Review. This form will also. The tax is one-tenth of one percent 0001 or 1 per 1000 of wages.

501c3 nonprofit and tax-exempt institutions. Your employer will be automatically withholding the taxjust like the personal income taxso you dont have to. Effective July 1 2018 Oregon workers must pay a Statewide Transit Tax to the state of Oregon at the rate of 001 01 on income that is subject to Oregon state income tax even if the employee is exempt from state income tax.

Skip to the main content of the page. Oregon employers must withhold 01 0001 from each employees gross pay. FAQ Oregon Department of Revenue FAQ.

When you set up the Oregon local taxes in QuickBooks Desktop the system automatically adds the Oregon Statewide Transit Tax rate which is 01. Wages Exempt From Transit Payroll Tax 1502670030. Statewide Transit Tax Statewide Transit Tax Statewide Transit Tax Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax.

Exemption from state income tax. The new statewide transit tax is calculated based on the employees gross wages before any exemptions or deductions. There is no maximum wage base.

Go to the Reports tab and select Employees Payroll. From the Oregon Department of Revenue website. 2 wages paid to nonresidents of Oregon while they are working in Oregon.

Heres how to do that. What is the Statewide Transit Individual Tax.

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

What Is The Oregon Transit Tax How To File More

New Transit Tax Cardinal Services

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

Solved I Do Not See The Oregon Transit Tax Or Unemployment Taxes Being Remitted By Quickbooks Do I Have To Remit These Myself

Oregon Transit Tax Procare Support

Ezpaycheck How To Handle Oregon Statewide Transit Tax